U.S. Green Building Council and Green Business Certification Inc. Announce the Top Countries and Regions for LEED Outside the U.S.

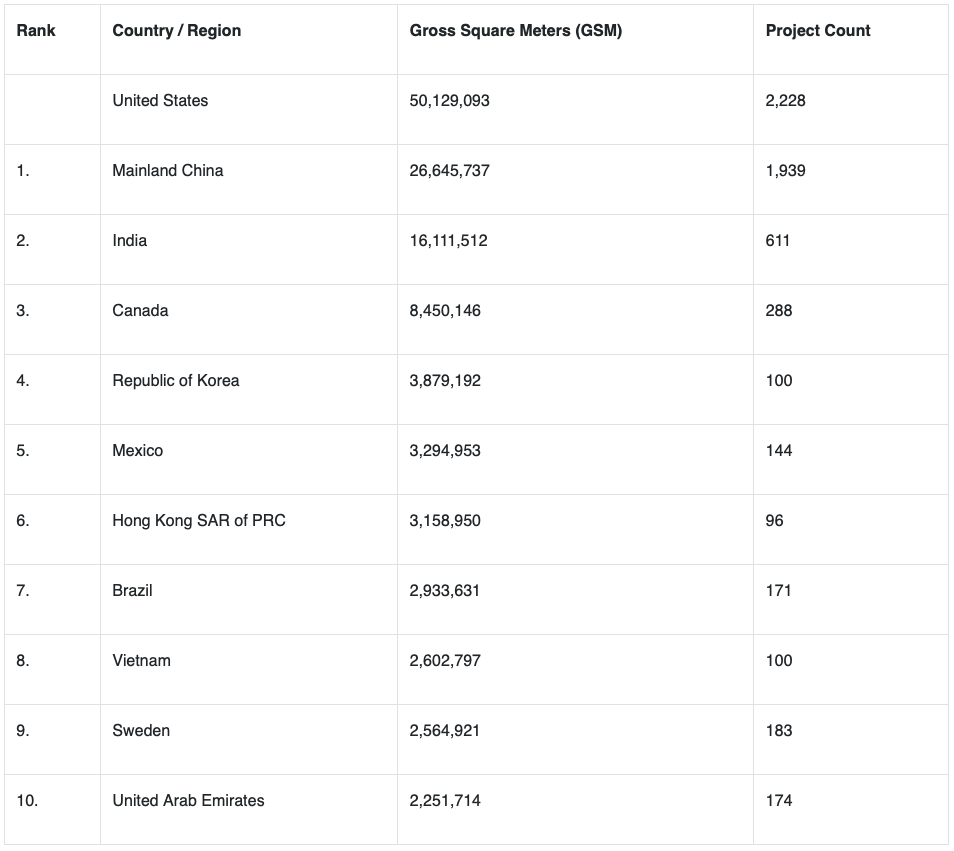

The U.S. Green Building Council (USGBC), the global developer of the LEED (Leadership in Energy and Environmental Design) rating system, and Green Business Certification Inc. (GBCI), the premier organization independently recognizing excellence in green business industry performance and practice globally, today announced the annual Top 10 Countries and Regions for LEED ranking outside the United States for 2025. While the U.S. remains the global leader in LEED adoption, once again mainland China achieves the top spot on the annual list outside the U.S., followed by India, with Vietnam securing a spot in the top 10 for the first time.

LEED certification continued to grow globally, with more than 7,500 LEED-certified commercial projects in 2025, equaling more than 147 million gross square meters (GSM). The U.S. remains the world’s largest market for LEED, with more than 50 million GSM of certified space. USGBC will announce the Top 10 States for LEED ranking in the U.S. later this month.

Throughout 2025, markets saw an uptick in the adoption of LEED certification for existing buildings, LEED for Operations and Maintenance (LEED O+M), demonstrating how building owners and managers are committed to cutting costs through energy efficiency and transforming buildings into high-performing assets. While this trend cuts across all sectors, warehouse and distribution projects were a primary driver of LEED growth globally, both in new construction and in existing buildings.

“The demand for LEED building certification continues to grow in our global markets, signaling that asset owners and occupants remain committed to long-term quality, sustainability, risk reduction and healthier spaces,” said Angelo Petrillo, chief growth officer, USGBC and GBCI. “In 2025, we saw tremendous growth in the number of warehouse and distribution facilities earning LEED certification in these Top 10 markets, which demonstrates the focus of building managers on operational efficiency and savings.”

Maturing markets in North Asia

Three North Asia markets — mainland China, Hong Kong SAR and the Republic of Korea — made the ranking, reflecting the region’s continued scale and depth of LEED adoption and underscoring market maturity.

Mainland China has remained in the global Top 10 consistently since 2016, highlighting sustained market commitment at scale. Warehouse and distribution centers remain a strong sector for LEED adoption, with a notable shift toward LEED (O+M) certifications for existing warehouses (now exceeding those for new construction). This shift signals a strong focus on operational performance.

In Hong Kong, existing building decarbonization has become a critical focal point. LEED O+M now dominates annual certifications, driven mainly by interior fit-outs. Additionally, recertifications accounted for around 10% of certifications in 2025, reflecting a growing emphasis on long-term operational performance.

South Korea remains stable and consistent in its adoption of green building certification, with office and warehouse sectors leading in uptake.

LEED growth across other Asian markets

India continues to be a large market for LEED projects, rising to second place in total LEED-certified space in 2025. The country saw more LEED O+M certification, outpacing new and interior construction projects and signaling a focus on ongoing performance. India’s real estate market is expanding rapidly, with new entrants increasingly adopting LEED—beyond offices into industrial manufacturing, warehousing, hospitality, retail and education.

Vietnam’s first year in the ranking is a testament to the country’s incremental growth over the years. In 2025, the most significant and exponential LEED growth was in industrial manufacturing and warehousing. The trend signals a structural shift in which export-facing production and logistics assets are increasingly positioned as global-grade, compliance-ready facilities—with LEED becoming a reliable tool for demonstrating ESG credibility, tenant attraction and investor confidence.

In the United Arab Emirates (UAE), LEED adoption can be attributed to market demand, the country’s climate commitments, and financial and international value propositions. Retail space was the fastest-growing sector in the country, driven by retail branches of financial institutions, luxury brands and outlets that turn to LEED to meet their larger ESG goals and to promote health and well-being as a key component of customer experience and satisfaction.

Warehouses and industrial projects drive LEED in Latin America

Brazil and Mexico once again represent Latin America, a region that continues to demonstrate growth in green building adoption. Both countries saw growth in warehouse and distribution centers, with retail, industrial and manufacturing projects also showing strong LEED adoption in the region.

Following global trends, Brazil saw growth in existing building projects, demonstrating a focus on operational performance beyond design and construction. In Mexico, green building certification has become a core component of asset quality, investor confidence and access to green finance, reshaping how real estate in the country is valued, financed and managed. This trend is supported nationwide through greater access to green loans and bonds, improved building codes, and higher market expectations.

“Our active participation in developing and applying LEED standards has kept us at the cutting-edge of the sustainability movement in Mexico,” said Lourdes Salinas, founder and director, THREE Consultoria Medioambiental, a Silver-level USGBC member based in Mexico. “This involvement has advanced the green building agenda and allowed us to adapt USGBC’s standards and certifications to the realities of Latin America.”

Sweden leads in Europe; Canada in North America

Across Europe, real estate markets reached a turning point in 2025, with capital and occupant demand increasingly concentrated in high-performance, future-ready assets. Investors and owners are prioritizing decarbonization, regulatory alignment, and long-term asset resilience, driving greater adoption of data-driven asset management practices. In this context, LEED is increasingly used as a strategic framework to support performance measurement, transparency and investment-grade credibility – with the growing uptake of LEED O+M reflecting the market’s broader focus on operational excellence and long-term value protection.

LEED projects in Sweden demonstrate leadership in large-scale circular construction and underscore the country’s role in advancing high-performance, sustainable real estate. This momentum is driven by regulatory pressure, decarbonization strategies, and investor requirements, with LEED being used as a long-term asset management tool.

Canada remains one of the biggest markets for LEED certification worldwide. Its position at number three outside of the U.S. reflects broad adoption across sectors, with office buildings, warehouses and distribution centers, and schools among the top adopters in the country.

Following is the full list of the top countries and markets for LEED outside the U.S. (ranked according to total LEED-certified space) in 2025: