10 Trends in Sustainability and How They Could Impact Your Business

When it comes to sustainability, we are truly at a crossroads. Governments and the private sector must act now if we are to limit global warming to 2.7°F before the end of this century.

“As the United Nations (UN) stated in 2021, it’s code red for humanity,” said Dr. Sally Uren, Forum for the Future chief executive. “We are really facing our last chance to lead.”

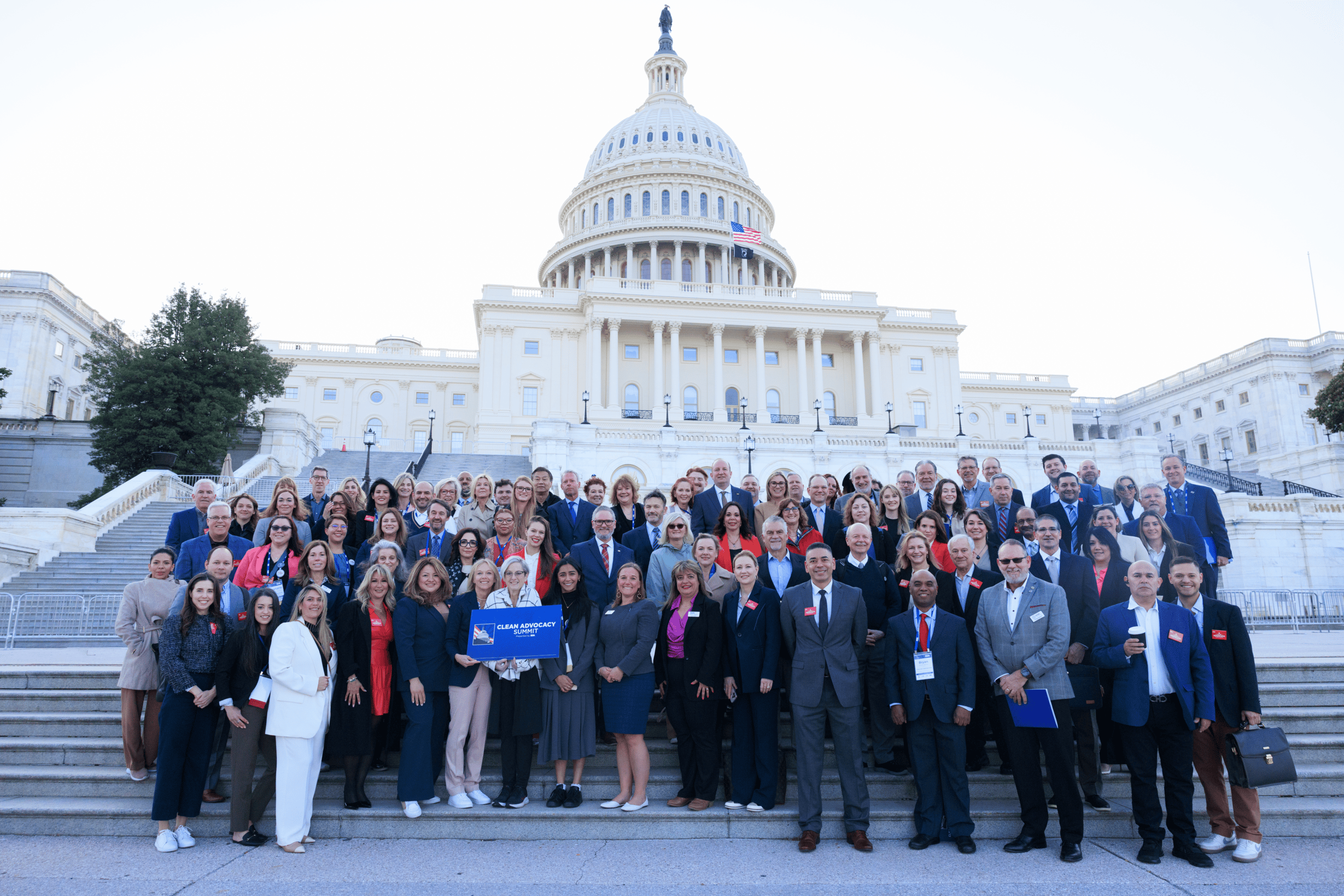

While climate change will have significant impacts on virtually everyone, Uren outlined 10 trends in sustainability that directly impact businesses in a recent online forum for a select group of Kimberly-Clark Professional customers.

- Climate disruption – Extreme weather. Catastrophic flooding. Rising sea levels and melting glaciers. All of this will cause disruption. The cost of inaction is projected to be US$1 trillion. But investing $1.8 trillion globally in five areas could generate $7.1 trillion in total net benefits, according to a 2019 report from the Global Commission on Adaptation.

- Biodiversity – Our food systems and all the natural systems that we rely on are dependent on biodiversity, yet, Uren said, we haven’t really factored that into our decision-making. Bees are a prime example. They are critical to pollination – without them we would not have a food supply. But climate change threatens their habitats. “$575 billion in annual crops are at risk from pollinator loss,” Uren said, adding that “after living through COVID-19, we know that planetary health equals human health. That’s why biodiversity is increasingly important from the lens of human health as well.”

- The circular economy – The circular economy is an economy whereas much material as possible is reused, recycled or refurbished. “There are fantastic opportunities here,” Uren said. “Think about the savings that could be generated if we’re using someone else’s waste instead of raw materials,” she said, adding that the circular economy is expected to generate $1 trillion of annual material savings globally by 2025.

- Land use – In order to shift from a fossil fuel economy to an economy based on renewable energy sources, we have to think about the best use of our land. “Here’s a sobering fact: If we carry on with agriculture as we have been doing, we’ll only have 60 years of harvests left,” Uren said. “Understanding how to restore our land and build soil health is crucial, especially because healthy soil can act as a carbon sink – something that absorbs more carbon from the atmosphere than it releases.”

- Demographics – By 2025, more than half the world’s populations will be millennials, a generation that is highly committed to corporate social responsibility and implementing sustainable development goals (SDGs). It’s something that must be considered when recruiting top talent and selling to these consumers. “Forty-two percent of millennials report starting or deepening a relationship with a brand due to positive socio-environmental impact,” Uren said.

- Rising inequality – Despite the efforts of government and the private sector, equality indicators are heading in the wrong direction. “Eighty-two percent of the wealth generated globally in 2017 went to the richest one percent, while half of the world’s population still lives on less than $5.50 a day,” Uren said. “This has got to change.”

- Public health – Climate change is perhaps the biggest public health crisis that we’re facing. It can lead to increased respiratory and cardiovascular disease as well as premature death from extreme weather, according to the U.S. Centers for Disease Control and Prevention (CDC). Uren cites mental health concerns as another health issue posed by climate change. “Eco-anxiety, which the American Psychological Association describes as chronic fear of environmental doom, is real,” she said.

- Changing investor attitudes – The investment community understands the value at risk from climate change, threats to biodiversity and social dislocation and has unlocked vast amounts of capital that could finance the transition to net zero, Uren said. “This is cause for optimism,” she added, citing that Global Assets Under Management in funds that weigh sustainability factors grew to $40.5 trillion in 2020, from $22.9 trillion in 2016.

- Demand for transparency – Increased investor interest in Environmental Social Governance, or ESG, issues is linked to a demand for transparency. “People want to know how and where their goods and services were made and the private sector is increasingly expected to disclose this information as well as information about sustainability and actions to combat climate change,” Uren said.

- Rising regulation – The European Union (EU) Green Deal is a game changer, according to Uren, by putting sustainability at the heart of the requirements for the private sector. Through a set of policy initiatives, it aims to turn the EU into a modern, resource-efficient, and competitive economy to combat the threat of climate change.

What does this all mean and how do we adapt to a changing climate? For business, Uren said, it means making and adhering to bold commitments – to achieve net zero, protect biodiversity and combat social inequality. “We need to move to Sustainability 4.0,” she said. “With businesses putting more back than they take out and actively shaping systems to move toward regenerative outcomes.”