Q1 2025 Cleaning and Hygiene Market Snapshot

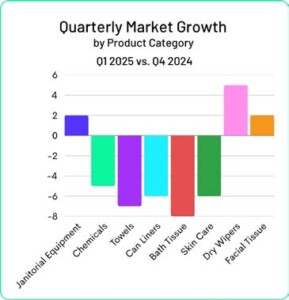

The start of 2025 brought tempered expectations across the cleaning and hygiene industry — and the latest data confirms why. According to Precision’s Q1 2025 Cleaning & Hygiene Report, total portfolio sales were down 7% year-over-year and 4% quarter-over-quarter, with nearly all product categories and end-user segments declining. Only Dry Wipers, Janitorial Equipment, and Facial Tissue showed modest growth compared to Q4 2024.

The start of 2025 brought tempered expectations across the cleaning and hygiene industry — and the latest data confirms why. According to Precision’s Q1 2025 Cleaning & Hygiene Report, total portfolio sales were down 7% year-over-year and 4% quarter-over-quarter, with nearly all product categories and end-user segments declining. Only Dry Wipers, Janitorial Equipment, and Facial Tissue showed modest growth compared to Q4 2024.

While not unexpected, the contraction is notable and signals a market that is still recalibrating in the wake of pandemic-era surges, price volatility, and shifting customer expectations.

Price Stability, But Volume Weakness

One of the most important insights from Q1 is that pricing remains relatively stable, changing less than 2% compared to both Q4 2024 and Q1 2024. This pricing discipline is a positive indicator, especially in a margin-sensitive category like cleaning and hygiene. However, the flipside is more sobering: unit volumes continue to erode.

In short, prices are holding, but buyers are purchasing less. That means the softness is driven by true demand contraction, not just pricing corrections — a key distinction for leaders trying to interpret market behavior.

Looking further back, the market is up 8% compared to Q1 2019, all of which is due to price and inflation. It’s clear – this is a market that remains in recovery following the pandemic and still reeling from the work-from-home movement.

Interpreting the Signals

The data paints a picture of a category that’s maturing and softening at the same time. As organizations manage tighter budgets and inflationary aftershocks, purchasing behaviors are becoming more cautious. End users are buying what they need — and little more.

The data paints a picture of a category that’s maturing and softening at the same time. As organizations manage tighter budgets and inflationary aftershocks, purchasing behaviors are becoming more cautious. End users are buying what they need — and little more.

Still, even in a cooling market, opportunities exist. The small gains in Dry Wipers, Janitorial Equipment, and Facial Tissue suggest specific product use cases, operational reinvestments, or institutional buying cycles that may be worth exploring further.

And longer-term, there are encouraging trends on the horizon. One hypothesis gaining traction: the “High-Traffic” end-user segments — including retail, hospitality, airports, entertainment, and travel — may see meaningful growth as Gen Z’s spending power increases. This generation places a premium on experiences over things, which could drive foot traffic and elevate the demand for high-frequency cleaning solutions.

Distributors and manufacturers should start thinking now about what that shift means for their portfolio, especially as it relates to staffing, equipment, and disposable usage in these high-traffic environments.

What to Watch Moving Forward

If Q1 2025 tells us anything, it’s this: volume is king, and it’s where attention must be paid. With price largely neutral, growth will come from either winning more share, targeting emerging segments, or creating more use cases.

Three takeaways for industry leaders:

- Use data to find the pockets of opportunity. Even in a down market, certain product lines and customer segments are outperforming. Don’t guess — measure.

- Plan ahead for generational shifts. Gen Z will reshape demand patterns. Those who align their product and channel strategies early will have an advantage.

- Watch for demand recovery in key verticals. High-traffic segments may be early indicators of recovery as experiential spending rebounds.

While 2025 is off to a slow start, there are signals — both in the data and in broader demographic trends — that point to where the next phase of growth may occur. For now, the smartest players in the industry will be the ones who use this period of contraction not to pause — but to plan.