The Continuity Planning and Collaboration Blueprint

It is no secret that the recent pandemic and subsequent supply chain breakdowns have affected our businesses. Lack of visibility of where products reside in the supply chain, not knowing if products will show up, inability to service customers with essential products like sanitizer, and recently resulting surpluses as demand for specific products go away, create a substantial oversupply.

Then, of course, there are the recent impacts of inflation on products, freight, and labor—unprecedented issues that we may not see in our lifetimes again. Even the most sophisticated companies couldn’t have anticipated the various challenges over the last two years. It’s been a wake-up call for our industry. In this article, I’ll be reviewing some new ways of thinking with regard to handling some of these challenges in the future and the importance of developing a continuity plan for the business.

Over the years, one of the gaps in our industry has been the inability to collaborate at a meaningful level and handle the highly variable business that we all must manage. When collaboration comes up in conversation, it invariably migrates to a discussion about promoting products, identifying sales targets, and developing revenue goals that both constituents can agree upon. That is important and ultimately must be part of a collaboration.

However, as demonstrated over the last 18 to 24 months, that process has left significant gaps. It is now essential for companies to be more collaborative and transparent in their planning. Companies must develop a continuity plan. To do this means taking a deeper dive into the business together as suppliers and distributors. There should be a multi-dimensional continuity plan that includes a stress test on the supply chains for the component companies.

Stress-testing components

Some fundamental steps come into play when developing a stress test for the business. These become more significant when viewed through the prism of supply chain collaboration.

Considerations include questions like: How long will it take our business and the supply chain to recover given a breakdown? Which part of the collaborative teams will be responsible for the specific solution? Who will lead? Who owns what in the supply chain process? When will the team recognize there is a breakdown in the chain?

It is so important to develop a designed solution that addresses preparation, prevention, and recovery. A solution thoughtfully developed will address the questions posed and provide “warning bells” when elements of the supply chain reveal stress. The tools of basic continuity planning include strategy mapping, scorecarding, and key performance indicators. Taken collectively, these tools can become the lighthouses of potential challenges to the business and any supply breakdowns.

Strategy map

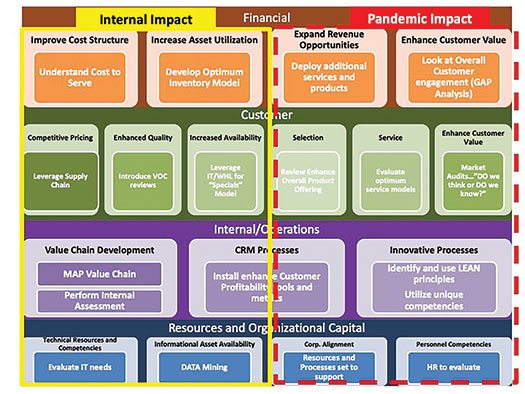

An effective continuity plan must begin with a strategic view into the objectives for the business during any given year and must reach into the operating activities of the business. Setting a series of goals related to adherence to forecast, operating costs, and other specific supply chain activities is important.

A strategy map provides the utility to see how the overall business, including operational processes, is performing for the business. The map addresses questions like: What are the required competencies that the business needs? What operational processes will be in place to support the business?

This is where the initial continuity discussion should come into play. The taxonomy of the strategy map is used to show where there are gaps in the things that must be true to ensure success. It links operations, technology, sales, and customers to one document. By developing this common language between the supplier and distributor, partners can evaluate and stress-test their business. Used effectively, it can preempt breakdowns.

Scorecarding

It can be argued that the most important of collaborative processes is developing a common language for both the suppliers and distributors to use to reveal their attainment of goals. It goes beyond the traditional view of sales performance.

Although the recent challenges couldn’t be preempted by the best of planning, scorecarding has the capability to reveal any downturn and uptick in the supply chain. When scorecarding is looked at through the lens of demand planning/predictive analytics and other key performance indicators (KPIs), it can prove to be a bellwether for challenges to come.

Many of these indicators don’t require a high level of sophistication, and most cases can be simple. Measurements like a percentage of back orders, on-time delivery, and a line fill, can be used to get started and can be revealing if watched regularly.

However, to be impactful and collaborative, it requires discussions that include the supplier. Supplier manufacturing capacity, raw material access, and other lethal challenges to the production of products should be quantified.

Furthermore, the percentage of demand variability against run rate, a review of macro-economic indicators like potential inflationary pressures, or a view into trucking performance demonstrated by longer lead times and route challenges can also prove to be very helpful in evaluating supply chain challenges. Consider the most recent chip issues as an example. Scorecards and continuity planning may not prevent these challenges, but they can reveal the impact on the business and what activities must take place to avoid further detrimental implications. With the development of key performance indicators and a willingness to be transparent, many issues can be diluted relative to their impact on the business.

At the end of the day, it comes down to the ability and willingness of the stakeholders to have meaningful, candid, and detailed discussions regarding the supply chain. The use of scorecarding can prove to be the language of collaboration and reveal any early onset of breakdowns within the business.

Scenario planning

Once the strategies of the business and scorecards are developed against the backdrop of minimizing supply chain disruptions, it is now time to pressure test the process. Essentially, this means that team leaders and members introduce stresses to the business and evaluate the ability of the business to recover.

Having been involved in this process, it can be a very relevant last step to ensure the plan in place will work. When this step is done well, it can reveal breakdowns that otherwise wouldn’t have been visible. Examples of this could be as simple as a breakdown in IT infrastructure and the inability to get orders transmitted to suppliers. Or a view into a potential hurricane hitting a manufacturing plant in the southeast, disrupting production.

Consider something as serious as a ransomware attack on our supply chains. Remember the issue some months back in Alpharetta, Georgia, and a petroleum pipeline? Although there are things that just can’t be anticipated, if part of the process of collaboration and the development of the business continuity plan is to stress-test the plan, supply chain disruptions can be preempted.

Business intelligence tools

Of course, there are many tools that can help with strategy, metrics, and continuity planning. Most recently, the use of Microsoft BI has been at the forefront as a robust tool to aid in the development of metrics. Multiple software as a service (SaaS) related programs can also provide the needed tools and are available. Oracle, Infor, SAP, and others are developing sophisticated tools, including supply chain towers, that can be implemented and easily provide the necessary information on risk.

Interestingly, machine learning is playing a bigger role, and some of the tools developed are incredibly impactful. However, it is important for the business to start the process, and there is no reason that a simple SQL database, a Microsoft Excel sheet, and basic business intelligence tools can’t provide the cornerstone for your supply chain continuity plan.

To conclude, the game has changed for distribution and our supply chain. For so many years, our ability to react to disruptions was to buy more product or stop buying product. The impact up and down the entire supply chain wasn’t all that critical because individual stakeholders felt they had the means to manage the challenge. Introduce the pandemic and what it revealed. Product allocation, lack of labor to meet the new demand as we recover from the pandemic, the inherent labor costs, and multiple price increases leading to rampant inflation. Truly unprecedented!

It’s unrealistic to think that even the most sophisticated planning could have prevented any of this. It couldn’t. However, with some rigor and discipline applied to the development of a continuity plan, stakeholders can mitigate some of the effect of major disruptions. In many cases, those who can do this well can provide a competitive advantage for themselves. Our industry must become more plan-oriented and transparent, or we will find ourselves in the inevitable supply chain breakdown that will come again.